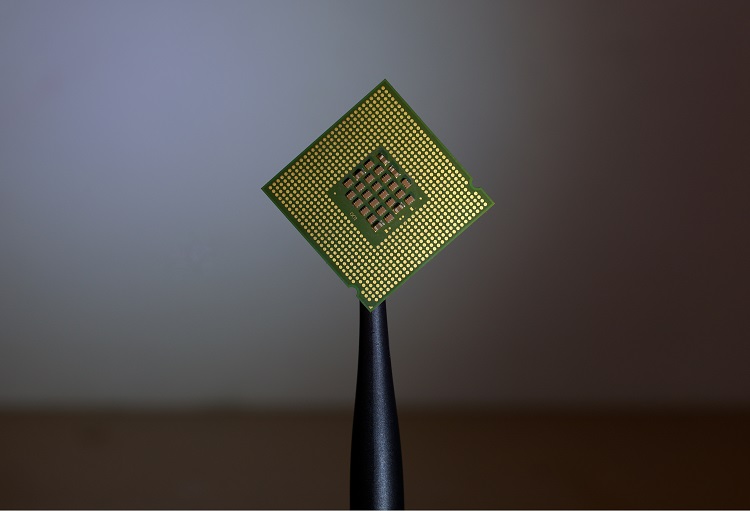

Nexperia, a Dutch chip firm owned by China’s Wingtech, confirmed on Monday that it plans to acquire the U.K.’s largest chip producer, Newport Wafer Fab.

The two people who are close to the deal told the media that the deal had been finalized and that the official announcement will be made early this week. Quite obviously the financial amount of the deal had not been made public but two CNBC sources said that it’s worth around £63 million ($87 million).

Achim Kempe, Nexperia’s chief operations officer, said in a statement: “The Newport facility has a very skilled operational team and has a crucial role to play to ensure continuity of operations. We look forward to building a future together.”

There has been some controversy going on around the country about Britain selling off an important asset to the Chinese in terms of a global crisis situation. It goes without saying that a lot of critics have commented on this deal made.

Tom Tugendhat, leader of the U.K. government’s China Research Group and chairman of the Foreign Affairs Select Committee, told CNBC on Monday “Having been in touch with partners in the U.S. and around the world, I know I am not alone,” he said.

“The semiconductor industry sector falls under the scope of the legislation, the very purpose of which is to protect the nation’s technology companies from foreign takeovers when there is a material risk to economic and national security,” he said. “When the U.K. signed the Carbis Bay G7 communique, we pledged to take steps to build economic resilience in critical global supply chains, such as semiconductors. This appears to be an immediate and very public reversal of that commitment.”

Tugendhat pointed out that the government is “yet to explain why we are turning a blind eye to Britain’s largest semiconductor foundry falling into the hands of an entity from a country that has a track record of using technology to create geopolitical leverage.”